By Dr. Julia Attwood, Head of Sustainable Materials, BloombergNEF

Automakers, consumer goods and equipment providers all have targets to decarbonize their supply chain. This puts pressure on their materials suppliers to send them more low-carbon, recycled, or sustainable materials: in particular, steel. But many of the technologies that can produce green materials at scale are not yet at commercial scale. Demand for green steel from sectors that can absorb the green premium – such as transportation – should help to de-risk the financing of commercial-scale low-carbon steel plants. For the next few years at least, while industrial decarbonization policy finds its feet, it will be private sector demand that drives the decarbonization of steel.

Net-zero targets spur demand for green steel: transport leads the way

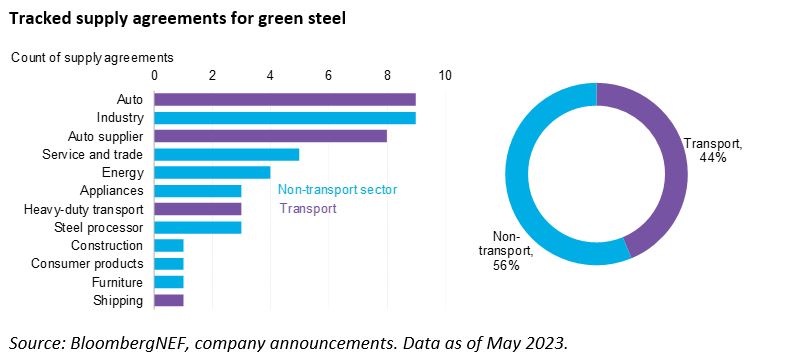

Since BNEF began tracking green materials procurement, a total of 48 green steel supply agreements have been announced. Of these, 44% involve the transport sector.

The transport sector is particularly active partly because automakers are facing regulation on a life cycle, rather than tailpipe, basis in Europe and are keen to showcase their environmental credentials as they roll out a new generation of passenger electric vehicles. The heavy-duty transport sector, which is much further behind on electrification, is also decarbonizing its materials, with the most high-profile agreement being Volvo Trucks’ purchase of SSAB’s first batch of fossil-free steel. Similarly, Mercedes Benz has signed an agreement with H2 Green Steel for 50,000 tons of steel made with hydrogen.

While automakers are an important source of green steel demand, they are a small fraction of steel demand overall. Transport comprises around 20% of steel consumption, similar to other heavy and electrical equipment manufacturing, but much smaller than the construction sector, at over 50% of demand. However, margins are thin in construction, and the demand for premium products like green steel always come first from sectors where materials are a small portion of the total cost of the product, and can be absorbed or passed on to consumers with little resistance. A 25% increase in the price of steel would only raise vehicle production costs by 1%.

Green steel will come with a green premium

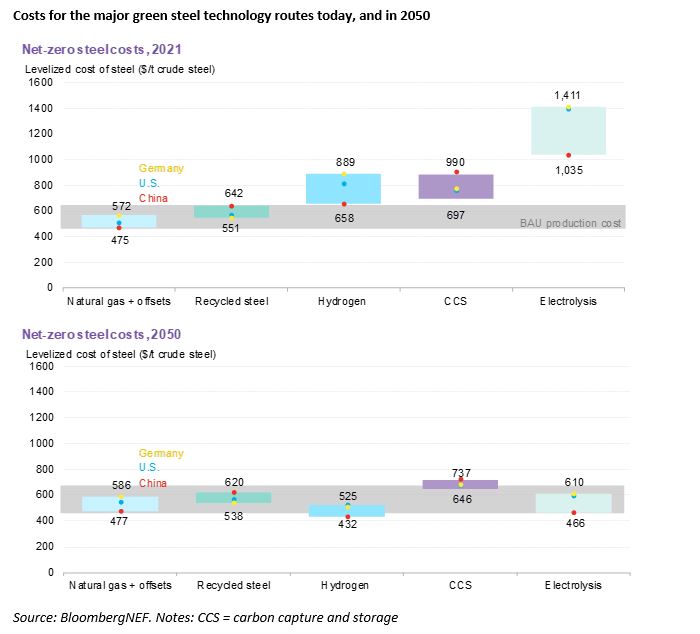

BNEF has calculated the cost of producing low-carbon steel through a number of novel production routes, including hydrogen-based direct reduction, and blast furnaces using carbon capture and storage (CCS). On average, green steel costs 40% more than unabated production today. However, these costs could fall by 2050, so that green steel costs 5% less than fossil-based routes.

These initial higher costs come from a combination of additional expenses across the capex, opex and development costs, often due to the more limited supply chains for new technologies. Development timelines are also typically longer, as the design and operating parameters for new plants must be created from scratch. Even retrofitting an existing plant comes with additional capex costs, such as refitting pipes and seals to securely contain hydrogen, or adding the tanks and pumps and heat exchangers needed for carbon capture.

We expect all these cost components to fall over time. Capex costs should decline through economies of scale, and development costs will fall due to greater experience with these building these projects. Opex costs are more uncertain. Intermittent renewable power costs are expected to fall to $10-20/MWh by 2050, but electrolysis-based steel production may require firm clean power, which could be closer to $50-60/MWh due to very high clean backup power costs. Hydrogen costs are also expected to fall, from around $7/kg today to less than $1/kg by 2050. This depends not only on cheap clean power being available to produce it, but also a dramatic ramp-up in demand to drive economies of scale in electrolyzer manufacturing.

Higher costs are eventually passed to customers as higher prices. Some steelmakers have been very transparent about their premiums. H2 Green Steel has disclosed that its steel will come at a 25% premium, and SSAB says its fossil free steel will be priced at 300 euros ($325) per ton higher than unabated steel.

Offtake agreements are crucial to scaling the industry

Most green steel projects are funded with a traditional project finance model, using a combination of equity and debt. For newer technologies such as hydrogen, carbon capture and electrolysis, the projects need to be de-risked. Offtake agreements, especially those that commit to buying green materials over several years can help to do that. This makes forming partnerships and selling off capacity, even before the plant is designed, extremely important.

Private sector demand is currently driving industrial decarbonization, one project and offtake agreement at a time. Most heavy industries have been shielded from the effects of carbon prices or other policy sticks over concerns about losing domestic production of a strategic material. Policy mechanisms like free allocations in the European carbon market for materials producers will only be wound down over the next decade. In the meantime, technology development and first-of-a-kind projects will be left to government grants and material customers to incentivize and finance.